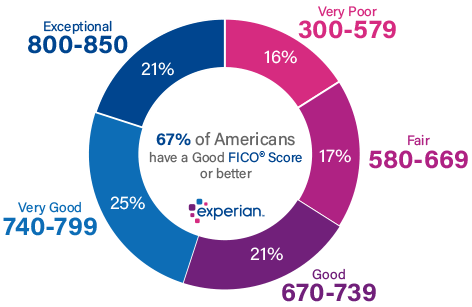

Whether you are just starting out as a new business owner or you have successfully been running one for quite some time, there are always new strategies that can help maximize your success rate in the marketplace. Your business credit score is more than a number. In fact, it can play a large role in the success of your business. A business’s credit score helps lenders, suppliers, and other creditors quickly evaluate whether the business will pay its bills on time.

Professional development

No matter what category your business happens to fall in, one thing is necessary in order for you to provide your customers extreme value: to make the commitment to continuously learn and study what’s “hot” in your field. If you spend an hour a day to learn about and research your field, you will instantly start to set yourself apart from your competition.

Customer value

Providing value in the lives of your customers is extremely important when thinking about creating lasting business success. If you are not changing or adding extreme value to your customers’ lives, your business will hit “stall mode” very quickly. The stall mode is when you truly believe you are doing everything right and working extremely hard, but the results and success aren’t present to show for it.

High-quality products/services

One of the quickest ways to set you apart from the competition is to provide your customers with high-quality products at the same price as your competitors. Quality is everything when it comes to growing your business. Spend the time to plan, organize and deliver top-notch quality products/services in everything you do.

1. Check your business credit report regularly and verify that the information is accurate and up-to-date.

2. Establish business credit with companies that report trades. Remember, not all business creditors report their trade information.

3. Pay your creditors on time. Historical payment behavior with previous creditors plays a major role in determining your business credit score.

Check your credit report

You can obtain your business’s credit report from the major credit reporting companies. These reports aren’t free—even if you’re the owner—but they’re always the first necessary step in getting squared away on your credit score.

Once you know your score, you know what you’re working with and can get the information you need to raise your score, including which accounts are negatively affecting your report and any disputable items on the report.

Pay your bills on time.

This is a no-brainer and one of the easiest ways to improve your business credit score, but if you do not pay your bills on time, your credit score will suffer, and anything else you do to improve your score will just be canceled out by the fact that you’re still a debt risk.

Decrease your credit utilization ratio.

One of the things credit reporting agencies look at when determining credit scores is the ratio of credit used in relation to the amount of credit available. It’s typically a good idea to keep that ratio under 15%.

• Pay off your balances: This is obvious but will ensure you decrease the ratio. If you can’t pay them off entirely, at least get them down as low as you can.

• Increase your credit limit: Ask your credit card provider to increase your limit, and voila, you’ve just decreased the ratio.

• Decrease credit card spending: Keep up the good work by decreasing the amount of money you spend on credit.

• Open a new line of credit: This may seem counterintuitive. Why would you want more credit available if you’re not going to use it? It’s all in the ratio. Having more credit available and not using it all makes you look good to credit reporting agencies.

• Pay your bills more than once a month: This will keep that ratio down as the spending won’t pile up over the course of the whole month.

Add positive payment experiences to your credit file.

Not all vendors and suppliers share payment data with business credit-reporting agencies, but you can add trade references to your company’s credit file manually through the credit reporting agency. The more positive payment experiences you can add to your file, the better.

“Pay for delete” with collections

If any of your debts went to collections, pay attention when it comes time to make good on your them. Make sure that the agency will delete the negative account from your credit report. You have to explicitly ask for this—otherwise, paying off this debt won’t help your credit score because it will still show a history of negative accounts.

Conclusion:-

Your business credit score is a critical factor in securing a business loan, among other things. But don’t fret, even if you have less-than-stellar credit, there are ways to improve your business credit score and graduate into better loan products over time. Nitinbang.com is an online business development company. You can contact or e-mail us for more information or any queries.

Leave A Comment